PUBLIC PRIVATE PARTNERSHIPS – AN OBVIOUS VIABLE AND MORE EFFICIENT OPTION FOR INFRATSRUCTURE DEVELOPMENT IN GHANA.

Ghana has continued its impressive governance performance in the last decade. Economic performance, though chequered within the same period, has to a large extent mirrored the improvement in the institutional framework necessary for businesses to thrive.

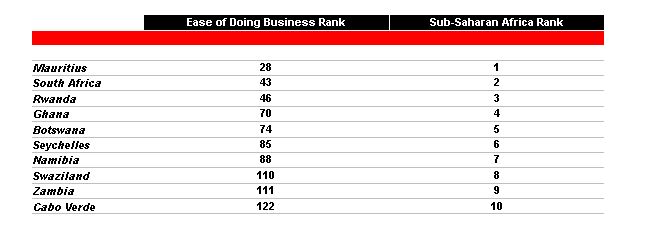

According to the World Bank’s 2014 “Ease of Doing Business” Survey, Ghana ranked high in almost all the indicators used in the survey. The country ranked 70th in the world and 4th in Africa behind Mauritius, South Africa, Rwanda and Botswana. The tables and charts below depict Ghana’s outstanding position among its peers in Sub-Saharan Africa.

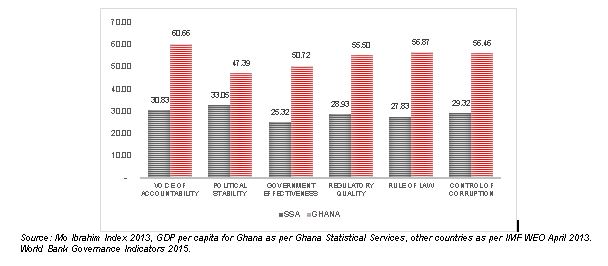

Ghana stands tall among its peers in governance, and did better than its peers in Sub-Sahara Africa in accountability, effective governance, quality of regulations and all the major governance indicators depicted on the figure below.

It is expected that with this enabling environment, Ghana would have soared much higher in economic development than it has done so far. The “soft issues” seem to be going in the right direction. What doesn’t seem to be working well are the “hard issues” which we define in this piece to be the infrastructure needed to move the wheels of development faster.

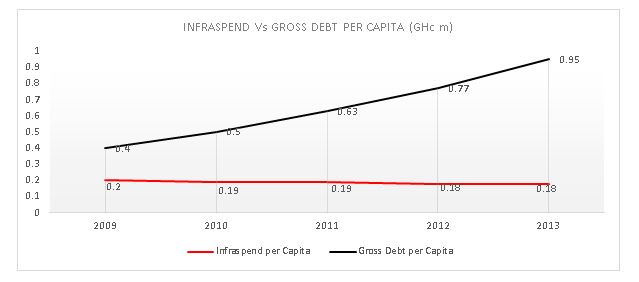

The reason for this situation is not farfetched. Figure 2 above shows the consistent drop in “infraspend” (the percentage of GDP spent on infrastructure per population) over the last 5 years. Provisional public debt as at September, 2014 stood at GH¢69,705.90 million (US$21,733.51 million). This was made up of GH¢40,644.15 million (US$12,678.62 million) and GH¢29,041.75 million (US$9,054.89 million) for external and domestic debt respectively. While we keep borrowing year-on-year to support re-current and capital expenditure, the proportion of this expenditure directed into infrastructure development has dwindled. It is understandable that the competing demands on the national budget has increased, but sacrificing infrastructure development is a dangerous choice as we may not be able to generate the foundation needed for future growth if we continue along this trend.

Job losses and collapse of businesses as a result of the energy crisis are clear examples of the danger of neglecting infrastructure development. The loss in productive man hours as a result of our inability to expend existing roads and diversifying our transportation network is a phenomenon explained purely by the limited investment in infrastructure development.

In the face of an ever increasing population, greater expectations, demands from the Ghanaian society and budgetary constraints, the government is facing enormous pressure to deliver new and improved infrastructure projects from transport, education; healthcare, waste management, water accommodation and defence. As in many countries, the financing requirements of current and future infrastructure needs far exceed resources available.

Rising into the middle-income bracket has limited Ghana’s financing options - concessional funding, both from donors and development partners, have reduced drastically. It is clear that the public purse can no longer provide the quantum leap we need to close the yawning infrastructure gap. It has therefore become necessary for government explore other ingenious options to finance projects, build infrastructure and deliver services to ensure that Ghana is able to stay competitive in attracting investment.

Globally, Public-private partnerships (PPP's) have been a reliable tool to harness the strengths of the private and public sectors in bridging the infrastructure gap. In addition to maximizing efficiencies and innovations of private enterprises, PPP's can provide the needed capital to finance public goods and services, thereby freeing up public funds for core economic and social programs. There are several active PPP markets around the world, including Canada, Australia and the UK. What tends to distinguish the leader countries is that PPP activity is conducted through a comprehensive government program rather than on a one-off basis as has been the case in the USA.

PPP involves an agreement between a public sector authority and a private party, in which the private party provides a public service or project and assumes substantial financial, technical and operational risk in the project. Several models have been designed and structured in the delivery of PPP`s. In some models, the cost of using the service is borne exclusively by the users of the service and not by the taxpayer. In other types (notably the private finance initiative), capital investment is made by the private sector on the basis of a contract with government to provide agreed services and the cost of providing the service is borne wholly or in part by the government. Government’s contribution to a PPP may also be in kind (notably the transfer of existing assets). In projects that are aimed at creating public goods like infrastructure development, the government may provide a capital subsidy in the form of a one-time grant to make it more attractive to private investors. In some other cases, the government may support the project by providing revenue subsidies, including tax breaks or by guaranteeing annual revenues for a fixed time period.

There are usually two fundamental drivers for PPPs:

Firstly, PPPs are enable the public sector to harness the expertise and efficiencies that the private sector can bring to the delivery of certain facilities and services traditionally procured and delivered by the public sector.

Secondly, a PPP is structured so that the public sector body seeking to make a capital investment does not carry any debt obligation. Rather, the PPP borrowing is incurred by the private sector vehicle implementing the project. Where the cost of using the service is intended to be borne exclusively by the end user, the PPP is, from the public sector's perspective, an "off-balance sheet" method of financing the delivery of new or refurbished public sector assets. Where the public sector intends to compensate the private sector through availability payments once the facility is established or renewed, the financing is, from the public sector's perspective, "on-balance sheet"; however, the public sector will regularly benefit from significantly deferred cash flows.

Benefits of PPPs

- Infrastructure created through PPP can improve the quality and quantity of basic infrastructure such as the provision of water and its treatment, energy supply and transportation. In addition the process can be widely applied to a variety of public services such as hospitals, schools, prisons and government accommodation.

- Construction will be completed to plan and to budget; repairs and maintenance are planned at the outset and in consequence assets and services are maintained at a pre-determined standard over the full length of the concession. Early delivery of good quality premises and services is delivering wide social benefits.

- PPPs help the public sector develop a more disciplined and commercial approach to infrastructure development whilst allowing them to retain strategic control of the overall project and service.

- In PPP structures the risk of performance is transferred to the private sector. The private sector only realises its investment if the asset performs according to the contractual obligations. As the private sector will not receive payment until the facility is available for use, the PPP structure encourages efficient completion, on budget without defects.

- There is evidence of better quality in design and construction than under traditional procurement. PPP focuses on the whole life cost of the project not simply on its initial construction cost. It identifies the long term cost and assesses the sustainability of the project.

- The use of private finance enables the public to have access to improve services now, not years away when governments spending programme permits.

- The expertise and experience of the private sector encourages innovation, resulting in shorter delivery times and improvements in the construction and facility management processes. Developing these processes leads to best practice and adds value.

- The process helps to reduce government debt and to free up public capital to spend on other government services.

- The tax payer benefits by avoiding paying higher taxes to finance infrastructure investment development.

- PPP projects can deliver better value for money compared with that of an equivalent asset procured conventionally.

- The PPP process requires a full analysis of projects risks at the outset. This fuller examination of risks by both the government and lenders means that cost estimates are robust and investment decisions are based on better information.

- PPPs are creating efficient and productive working relationships between the public and private sector.

To achieve the infrastructure developmental goals as a nation, we should fully embrace the idea of Public Private Partnerships. Using private funds to deliver public infrastructure will help avoid unnecessary accumulation of public debt while tapping the expertise of the private sector to meet our infrastructure needs as a nation. In the past PPP’s have been quite unorganised but with more education the government will succeeded in injecting the required confidence and assurance to encourage private sector participation in infrastructure development. We must recognize that the demands on the government are immense and unless the private sector builds its capacity in lobbying to encourage government to pursue growth oriented policies, the balance of resource allocation will perpetually be tilted towards unsustainable social interventions.

By:

Isaac Ocquaye-Allotey, Senior Associate, C-NERGY Global Holdings

Laila Dwiejua, Analyst, C-NERGY Global Holdings